AFR 2024

-

Statement by the person responsible

Having taken every reasonable measure for this purpose, I declare that to the best of my knowledge, the information contained in this annual financial report is accurate and does not omit any material fact.

I declare that to the best of my knowledge, the financial statements were prepared in accordance with the applicable accounting standards and that they provide a faithful presentation of the assets, financial position and income of the company and all the companies included in the consolidation, and that the management report appearing on page 4 presents an accurate picture of the business, income and financial position of the company and all the companies included in the consolidation, as well as a description of the main risks and uncertainties to which they are exposed.

-

1 Board of Directors’ management report

Economic environment

In 2024, the global economy once again demonstrated its resilience, managing to absorb the successive shocks that have occurred since the post-Covid period. However, the emergence of new risks such as the escalation of the conflict in the Middle East and the emergence of a populist wave around the world, has raised the spectre of geo-economic fragmentation.

Although a global recession was avoided, the global recovery remains fragile, as can be seen in the January 2025 update of the International Monetary Fund (IMF) economic outlook. The institution forecasts global growth of 3.2% in 2024, slightly down compared to growth in 2023 and lower than the average growth prevailing over the decade preceding the pandemic.

Global economic growth seems to be stabilising, however, with significant disparities between the various regions of the world. The growth rate of emerging economies is more favourable. Despite a struggling Chinese economy, which is expected to narrowly miss the growth target set by the government, annual growth in emerging economies is expected to stand at 4.2%. It is a more contrasting situation for advanced economies with annual growth expected to peak at 1.8%.

The United States is again a leading figure among the advanced economies. Recession, which was anticipated by the markets, has still not occurred and it even seems that the US Federal Reserve has won its bet of a soft landing for the US economy.

Economists have again been pleasantly surprised this year by the economy's greater-than-expected resilience, particularly with regard to household consumption expenditure and exports. The IMF therefore revised its growth forecasts upwards for 2024 to 2.8% compared to the 2.1% forecast at the beginning of the year. Gross Domestic Product (GDP) growth increased by 3.1% year-on-year in the third quarter according to the third estimate of the Bureau of Economic Analysis (BEA).

Indicators on the employment front, such as the unemployment rate or the creation of non-agricultural jobs, show a still buoyant labour market, even if a slowdown in this trend has been observed, a sign that the tension is less significant than it may have been in the past. The US unemployment rate stood at 4.1% in December.

Other indicators which have shown the strength of the US economy this year, are the leading Purchasing Managers Index (PMI) or ISM indexes, which measure business growth. The PMI Composite index of overall activity reached 55.4 points at the end of the year, thanks in particular to extremely positive activity in the services sector. The index in this sector reached its highest level for 33 months in December at 56.8 points.

The two drivers, France and Germany, are operating at reduced capacity at present. Germany is suffering from the crisis of its economic model in addition to a political crisis. According to the publication of the German National Institute of Statistics (Destatis), the country is in recession for the second consecutive year with a Gross Domestic Product (GDP) in 2024 down by 0.2%.

As for France, it was plunged into political uncertainty in June with the decision to dissolve the National Assembly. Early legislative elections followed, which did not result in a clear majority. The second half of the year was therefore unstable politically, culminating in the passing of a motion of censure in early December on the vote of the 2025 Social Security budget, thus bringing down the government that had been in office for barely three months.

Economic operators, households and businesses are adopting a wait-and-see attitude in this climate of uncertainty, which is likely to weigh on future growth.

GDP is expected to stand at +1.1% in 2024, as indicated by INSEE's (French National Institute of Economic and Statistical Information) first estimate on the French national accounts for 2024, thanks in particular to a third quarter that benefited from the impact of the Olympic Games.

The excellent performance of the Spanish economy stands out, which benefited from the dynamic momentum of its tourism sector as well as strong domestic demand. The country is also seeing a significant improvement in its public finances. According to the Instituto Nacional de Estadistica, growth is expected to be +3.2% over the year.

Growth for the Eurozone as a whole is expected to be less than 1%, based on the IMF’s January 2025 economic forecast update, which expects growth of 0.8%.

An abundance of activity indicators point to a sluggish level of activity in the Eurozone. The PMI Composite index hovered around the 50-point level throughout the year without taking a clear step in either direction. This is the level that separates a zone in which activity is expanding from one in which it is contracting. It stood at 49.6 points at the end of the year. The weakness of manufacturing activity is still notable, with an index which has been in contraction territory for more than two years.

The European Commission's indicator, which measures economic confidence via a survey of economic agents, is changing below its long-term average, with a downturn in the second half of the year.

However, the job market in the Eurozone remained favourable this year with a positive trend in job creation. The unemployment rate was down over the year to 6.3% in December, compared to 6.5% a year earlier.

In a context of falling interest rates for the main central banks, the performance of global stock market indices was clearly positive this year, with the exception of the French index, which was constrained by the domestic political context.

Stock market indices across the Atlantic posted double-digit growth, such as the Nasdaq Composite, which recorded the strongest growth at more than 28%. The S&P 500 gained slightly more than 23% over the year to 5,882 points. For the world’s oldest stock market index, the Dow Jones Industrial Average, the performance was nearly 13%.

In Germany, the DAX recorded a remarkable increase of just under 19% in 2024, reaching a level close to the symbolic threshold of 20,000 points. The Eurostoxx 50 increased by 8.3% and closed 2024 at 4,896 points.

In France, the flagship index of the Paris market, the CAC40, suffered from the troubled political context and resulting uncertainties, posting a decidedly lacklustre performance compared to its peers. It closed the year at 7,381 points, a decline of more than 2% over the year.

On the commodities market, the price of a barrel of Brent, like its US counterpart WTI, remained relatively stable during 2024 despite a turbulent geopolitical context. Faced with declining demand, the member countries of the intergovernmental organisation (OPEC) maintained their production reduction target. A barrel of Brent fell 3.1% while WTI ended up +0.1% at just under US$72 per barrel.

For crypto-assets, 2024 will be marked as the year Bitcoin crossed the symbolic threshold of US$100,000. The price of the Queen of cryptos soared at the end of 2024, buoyed by the election of Donald Trump and the promise of deregulation.

The persistence of geopolitical (conflicts in the Near and Middle East, in Ukraine) or political tensions (American election, dissolution of the French National Assembly) coupled with growing demand from central banks, particularly the main emerging countries, which want to “de-dollarise”, resulted in a rise in the price of gold to more than US$2,600 per ounce at the end of the year.

Interest rate trends

After several years of fighting galloping inflation, which had reached a high of nearly 10% in the United States and was even higher in the Eurozone, 2024 was the year when turning points were reached for the major central banks.

A year of transition during which central bankers began to ease key rates, made possible by the disinflation phase that continued this year in most regions.

Inflation in the Eurozone stood at 2.4% in December, 0.5 percentage points lower than its December 2023 level. It should be noted that an unfavourable base effect, particularly on energy, resulted in an upward trend in overall inflation in the last quarter. However, after restating for volatile items, it is clear that inflation has indeed been reduced. Concerning the continuation of the disinflation trend, it should be noted that inflation in the price of services has been stable at 4% for the past year.

In this context, the European Central Bank (ECB) initiated the normalisation of its monetary policy at its meeting in June with a first cut in key rates of 25 basis points. The movement continued at its meetings in September, October and December. The deposit rate was thus reduced by 100 basis points over the full year to stand at 3% at the end of the year. In March, the Governing Council also issued a report on the review of the operational framework for the implementation of monetary policy. As such, the difference between the deposit rate and the main refinancing rate was reduced by 35 basis points in order to promote the transmission of the Council's decisions in the money market.

At 31 December, the main refinancing rate was therefore 3.15% and the marginal lending facility rate was 3.40%.

As regards the ECB's balance sheet, it continues to be reduced at a measured and predictable pace, as the Governing Council has ended the reinvestment of the principal from maturing securities under the APP (Asset Purchase Programme), as well as those from the PEPP (Pandemic Emergency Purchase Programme) portfolio since December.

The President of the ECB, Christine Lagarde, expressed confidence at the final meeting of the year in achieving the medium-term target of 2% for the future trajectory of European inflation. Disinflation is “on track” according to Ms Lagarde. At this stage, the underlying inflation measures point to a return to 2% in the near future.

In the United States, the US Federal Reserve (FED) waited a little longer than the ECB before initiating a rate cut but the cut was larger than its European counterpart's, with an initial reduction of 50 basis points in September.

However, the total for the year was similar, with a downward trend totalling 100 basis points. At the end of the year, the Fed Funds were in the [4.25%; 4.50%] bracket.

On the other hand, the US Governing Council has been more cautious about the trajectory of future reductions.

The US election which captured the world's attention in November and resulted in Donald Trump's victory leaves many questions unanswered. The newly elected President's programme contains measures that are inflationary. It remains to be seen to what extent they will be implemented.

As such, the members of the Federal Reserve are anticipating only two rate cuts of 25 basis points each in 2025, compared to four previously.

In this context of lower key rates, the movement was reflected in the money markets and in particular short-term rates.

In Europe, the benchmark rate for overnight transactions, the €ster, fell by 98 basis points to 2.91% at the end of the year compared with 3.88% a year earlier. The three-month Euribor was down by 119 basis points and ended the year at 2.71%, close to its lowest point of the year.

The inversion of the euro long yield curve that prevailed at the end of 2023 is no longer relevant. In September, the yield curve reversed. The curve has therefore steepened over the year, particularly due to the more significant drop in short-term maturity rates.

The 2-year Swap rate fell by 58 basis points, standing at 2.13% on 31 December, while the 10-year Swap rate fell by 11 basis points to 2.35%.

In the United States, the revision of interest rate cut forecasts by FED members at the end of the year contributed to the flattening of the US yield curve. The 2-year Swap rate closed the year at 4.08% and the 10-year rate at 4.07%.

Regarding sovereign debt, the political situation in France weighed on French government OAT (medium and long-term treasury securities) yields. The rate spread between the yield on French and German debt, which is the measure generally scrutinised by investors to monitor the specific French risk, thus surged to stand at 83 bps at the end of the year. It was 33 bps lower prior to the announcement of the dissolution of the French National Assembly, at 50 bps. The 10-year yield on French debt thus stood at 3.19% compared to 2.36% for the yield on German debt of the same maturity. Conversely, the perception of risk for Portugal, Spain and Italy has improved. The US 10-year ended the year at 4.57%.

-

2Banque Palatine Sustainability report

Part 1 - General information

1.1Basis for preparation

1.1.1BP 1 - General basis for the preparation of sustainability statements

Banque Palatine has prepared its sustainability report in accordance with European Sustainability Reporting Standards (ESRS). These standards provide a comprehensive framework for the disclosure of non-financial information on environmental, social and governance issues.

The bank's sustainability report is based on a double materiality approach, which takes into account both Banque Palatine's impact on the environment and society, and the impact of environmental and social issues on the company's performance. This approach ensures that the sustainability report is relevant to all stakeholders, including employees, investors, customers and the communities in which the bank operates. It also includes a presentation of the risks and opportunities related to sustainable development facing the bank.

Scope of the sustainability report

Banque Palatine prepared this report by collecting data on a consolidated basis, from all its activities and its value chain, both upstream and downstream. This sustainability report is audited, as required by the regulations, with a limited level of assurance, as detailed in the audit paragraph below. The scope of consolidation used for the sustainability report is the same as for the financial statements.

The following subsidiaries are included in Banque Palatine's consolidation and are exempt from the obligation to provide individual and consolidated sustainability information: Palatine Asset Management and Ariès.

Any exclusions from the reporting scope by family of indicators are mentioned in the description of each indicator or in footnotes where applicable.

1.1.2BP 2 - Disclosures in relation to specific circumstances

1.1.2.1Time horizons

In most cases, the significant impacts, risks and opportunities have been assessed in the short, medium and long term. The short term refers to the presentation period of the annual financial statements. To provide forward-looking information on the bank's significant impacts, risks, and opportunities in its sustainability statements, Banque Palatine, in accordance with Groupe BPCE, has adopted the general principles set out in section 6.4 of ESRS 1, namely:

When the time horizons deviate from these general guidelines, this information is communicated at the same time as the relevant information concerning the specific material subject. During the preparation of this sustainability report, forward-looking estimates and assumptions were made. The results observed may differ from these estimates and assumptions.

1.1.2.2Value chain estimates

The indicators must cover the entire consolidated scope. However, for the calculation of greenhouse gas emissions under ESRS E1-6 (greenhouse gas emissions), the indicator is calculated over an extended scope. Scope 3, category 15 emissions relate to the value chain, in particular financed emissions.

In order to calculate Scope 3 category 15 emissions on the banking portfolio, greenhouse gas data come from several sources:

- •purchase of supplier data (Carbone4, Trucost, CDP);

- •data collected from Banque Palatine customers (EPD - Energy Performance Diagnostic); and

- •public databases (Centre Scientifique et Technique du Bâtiment and ADEME).

When data is not available, Groupe BPCE, which performed the calculation for all the entities within its scope concerned by the sustainability report, including Banque Palatine, uses sector-specific intensity estimates: extrapolation or PCAF proxy.

1.1.2.3Sources of uncertainty concerning estimates and outcome

This report, known as the "Banque Palatine sustainability report", was prepared in accordance with the legal and regulatory requirements resulting from the transposition of the European Directive on the disclosure of information on companies' sustainability (Corporate Sustainability Reporting Directive or “CSRD Directive”). This first year of application is characterised by uncertainties about the interpretation of the texts, which are generalist and cover all sectors of activity but do not specify a specific framework for banking and financial business models. There is also the absence of established practices or comparative information and certain data, in particular within the “value chain”.

With regard to what follows, Banque Palatine has drawn on all the work done by Groupe BPCE in preparing its own sustainability report.

Groupe BPCE has endeavoured to apply the normative requirements set by the ESRS, as applicable at the date of the sustainability statement, based on the information available within the timeframe for its preparation, by doing its best to reflect its role as a universal bank-insurer, as well as its various business models.

For the double materiality analysis and, in particular, that relating to its value chain, Groupe BPCE encountered limitations relating to the maturity of its valuation methodologies and the availability of data. As presented in section 1.4.1.1 on the Environment (E), we considered that only the issue of mitigation and adaptation related to climate change is material within the meaning of the standard. The limitations on the information and methodologies available at this stage did not enable the materiality of Nature-related ESRS to be determined in accordance with the standard, which resulted in the Group assessing these environmental issues as non-material. This assessment was based on the definitions of the standard, and the methodologies available to assess and carry out the rating exercises. This assessment is mainly explained by the lack of consensus on robust methodologies developed for the issues in question, and the lack of relevant and appropriate data that would enable a link to be established between the impact or risks for Groupe BPCE on these issues throughout its value chain. In view of Groupe BPCE’s continuous improvement approach to these environmental issues, the work and ongoing changes in international methodologies, the standards that are being put in place, the best market practices that are emerging and information and data from its customers, which should gradually become available, this double materiality analysis may change in the coming years. The dual materiality analysis, the results of which are presented in this report, aims to qualify the impacts, risks and opportunities as described in the CSRD standard: this analysis only meets the needs of sustainability reporting and not the analysis of factors risks presented in the chapter on risk management.

For the data points presented in this report, Groupe BPCE used methodological options that it deemed relevant and estimates for numerous data, particularly concerning the various activities in its value chain. The data, analyses, and studies carried out do not guarantee that expectations and targets will be achieved: they are based on objectives, commitments, estimates, assumptions, standards, and methodologies under development and currently available data, which continue to evolve and develop. Some of the information in this document was obtained from public sources, sources that seem reliable, or market references: Groupe BPCE has not verified it independently. In addition, Groupe BPCE notes that the information expected in terms of sustainability is based on so-called “agnostic” European standards (ESRS), which are generalist and do not reflect the specificities of the financial sector. As a result, certain data items deemed irrelevant or inapplicable, in the light of Groupe BPCE’s business models and value chain, have not been produced. The same applies to certain data points relating to the taxonomy regulation.

The Banque Palatine has not defined a transition plan for the first CSRD financial year specifically for climate change mitigation and adaptation. However, as a member of Groupe BPCE, it contributes to the implementation and performance of the transition plan through its business model and specific characteristics. This is described in Groupe BPCE’s sustainability report. It differentiates between actions relating to its own operations, targets and actions that it has set itself in order to contribute to decarbonising the economy by supporting its customers. The actions described present, in particular, the achievements and roadmap for the actions that appear to impact the downstream value chain. The Group’s transition plan describes past, current and future efforts to align its financing, investment and insurance portfolios with scientifically established trajectories aimed at achieving global carbon neutrality by supporting its customers with their environmental transition. Groupe BPCE's report does not quantify the effects of decarbonisation levers or future estimates of total financed emissions. The actions undertaken by the Group cannot replace those of the individuals, companies or governments it supports in the transition, and the transition to a low-carbon economy depends on many factors outside the control of Groupe BPCE.

Regarding the assessment of greenhouse gas emissions, as a service company, Groupe BPCE emits a limited level of CO2eq in terms of its own operations, including by integrating the upstream value chain (purchases, including those related to IT and technological investments, mobility including business trips, etc.) and its customers travelling to its branches or business centres. Most of Groupe BPCE’s GHG emissions come from financed emissions and are subject to a normative calculation for category 15 for downstream “investment” value chain emissions, otherwise known as “financed emissions”, aimed at attributing to the financial institution a portion of the CO2 emissions of its financed customers or securities in which it invests. This calculation takes into account scopes 1,2 and 3 of the customers, which also includes the emissions of their value chain and leads to a maximalist calculation. It is estimated that financed emissions can, on average, account for three times the same greenhouse gas emissions for portfolios exposed to companies in the same value chain. For this sustainability statement, the Group considered the mandatory categories of financial assets provided for in the Greenhouse Gas (GHG) protocol for calculating financed emissions. The scopes, methodologies used and the main assumptions and data sources are detailed in the paragraph relating to (E1-6) “Gross Scopes 1, 2, 3 and Total GHG emissions”.

With regard to Taxonomy, the assumptions used and limitations are detailed in chapter 2.1 Indicators of the European taxonomy on sustainable activities.

Groupe BPCE believes that the expectations reflected in these forward-looking statements are reasonable, however they are subject to numerous risks and uncertainties, they are difficult to predict, generally outside of the control of Groupe BPCE, sometimes unknown and liable to lead to results or transform events that are significantly different from those expressed, implied or anticipated by said forward-looking information and statements.

1.1.2.4Changes in the preparation or presentation of sustainability information

The sustainability report for the 2024 financial year is the first such report produced by Banque Palatine. No change in the definition or calculation of metrics, including those used to set targets and monitor progress towards their achievement, is to be reported.

1.1.2.5Reporting of errors in prior periods

As indicated above, as this financial year is the first, comparative data with previous periods are not presented. The reporting of errors in previous periods does not extend to the reference periods preceding this first year of application of the sustainability standards by the company. Furthermore, no significant error related to the previous Green Asset Ratio (GAR) period was identified.

1.1.2.6Publication of information from other legislation or widely accepted sustainability information frameworks

Banque Palatine has defined sustainability risk as a risk factor in its risk management framework. The chapter on environmental, social and governance risks under Pillar III ESG describes how the bank defines and manages these risks. This chapter also contains an overview of the impact of climate and environmental risks on other types of risks. Further details on the methodologies and management used for traditional types of risks, such as credit risk, market risk, operational risk and liquidity risk, are provided in chapter 4 Risk Factors and Management.

In addition, the elements relating to the eligibility and alignment of the Group’s portfolio as defined in regulation (EU) 2020/852 and supplemented by delegated regulations (EU) 2021/2178, 2021/2139 and 2023/2486 are included in chapter 2.1. Indicators of the European taxonomy on sustainable activities

1.1.2.7Incorporation of information by reference

In order to avoid repetition, ESRS 1 allows sections prepared in other documents, such as the management report, to be incorporated by means of a simple reference, provided that the information is equivalent, particularly in terms of reliability. This generally concerns the sections relating to the description of the company’s activities and strategy, its governance, remuneration policies, risk factors and the duty of care. The ESRS consider that it is essential to ensure and explain consistency between the sustainability report and the financial statements, paying particular attention to significant amounts, assumptions and projections. The amounts considered material from the financial statements must be accompanied by a reference, although the presentation of a comparison table between the amounts in the sustainability report and those in the financial statements remains optional.

Name of the disclosure

requirementData point

Registration Document

Section of the Registration

DocumentDisclosures in relation to specific circumstances

ESRS BP-2 Para. 15

Annual report

Chapter 4 Risk Management Report

The role of the administrative, management and supervisory bodies

ESRS 2 GOV-1 Para. 19 & 21

Annual report

See chapter 1.3 "Report on corporate governance"

Risk management and internal controls over sustainability reporting

ESRS 2 GOV-5 Para. 36 (a)

Annual report

Chapter 4 Risk Management Report

1.2Strategy

1.2.1SBM 1 - Strategy, business model and value chain

1.2.1.1Sustainability-related strategy

Banque Palatine is part of Groupe BPCE, the second largest banking group in France. A little less than 1,100 employees serving 46,000 corporate customers and 13,500 private customers work closely with natural persons or legal entities, responding in a concrete way to the needs of the real economy.

In 2024, faced with environmental, demographic, technological and geopolitical challenges, Banque Palatine is fully committed to financing French medium-sized companies and supporting all its customers in adapting to their new environment.

At the same time, Banque Palatine was attentive to the working conditions of its employees during a year marked by the development of its new model and moving upmarket. Efforts focused on career support, mobility, skills development and recruitment.

On the environmental aspect, in addition to the continuation of awareness-raising workshops on climate issues for the bank’s employees, a Sustainable Finance Programme was created to improve the support and transition services offered to customers.

Faithful to its commitment to community involvement and its values, Banque Palatine continued its societal actions, made donations and supported charitable projects (see section 1.2.3 Sponsorship policy – partnerships).

Characterised by gender-balanced governance, promoting gender equality is therefore a key focus of its strategy.

Banque Palatine therefore intends to continue all its projects aimed at promoting greater integration of environmental and social issues into its activities and relations with its stakeholders between now and 2030. This will notably involve continuing to provide special support to its medium-sized corporate customer and senior executives committed to sustainable, low-carbon and carbon-neutral growth, and including three separate projects with clearly defined objectives in its new Palatine 2030 strategic plan.

1.2.1.1.1Sustainability-related strategy

Palatine 2030 traces the major strategic priorities set in order to build its new strategic plan for the benefit of its customers. Banque Palatine’s VISION 2030 is reflected in seven markers that embody an ambitious development plan combining innovation, excellence and performance, as described in section 1.2.1.2.2.

Environmental impact

The latest IPCC assessment report published in 2023 highlights the continued increase in greenhouse gas emissions worldwide and the growing impacts of climate change and damage to ecosystems and populations.

Faced with the climate emergency, Groupe BPCE and Banque Palatine's approach aims to rapidly implement and deploy measures to mitigate and adapt to the already tangible environmental and socio-economic impacts of climate change and the erosion of biodiversity. Making impact accessible to all means raising awareness and massively supporting all its customers in the environmental transition through expertise, consulting offers and global solutions.

By drawing on the scenarios defined by science, Groupe BPCE and the Banque Palatine are positioning themselves as facilitators of transition efforts, with a clear and ambitious objective: to finance a carbon-neutral economy in 2050 by taking action today.

-

•Impact

solutions

-

•for

Private Banking customers: support energy renovation by offering financing

solutions and by mobilising its role as an operator, trusted third party as well as its

partnerships:

- −by offering a "Sustainable Advice and Solutions" tool in partnership with ADEME, enabling people to easily calculate their carbon footprint and receive advice and assistance for energy renovation work, carbon-free mobility or green savings,

- −by supporting energy renovation projects for condominiums at each stage: energy assessment, search for subsidies, completion of work guarantee, with pathways and financing adapted to each situation,

- −by increasing the number of financing for the energy renovation of buildings,

- −By offering sustainable solutions for investor customers with a range of responsible savings and investments: sustainable development passbook savings accounts, funds with a sustainable investment objective, themed-labelled funds, etc.;

- •for corporate customers: supporting the transition of its medium-sized corporate customers’ business models. Banque Palatine is committed to engaging in dedicated dialogue and providing sector-specific expertise to integrate ESG issues according to their size and economic sector, particularly in energy and transport infrastructure etc.;

-

•for

Private Banking customers: support energy renovation by offering financing

solutions and by mobilising its role as an operator, trusted third party as well as its

partnerships:

-

•a

support for the evolution of the energy mix: faced with the climate emergency, the priority is

to accelerate the transition to a sustainable energy system:

- •by playing a leading role in the financing of debt projects for the renewable energy sector,

- •by increasing its financing dedicated to the production and storage of green electricity,

- •by providing financial support and advice through specialist partners to assist the energy transition of medium-sized companies, particularly in the industrial sector,

- •by supporting the reindustrialisation of regions and energy sovereignty,

- •by leveraging dedicated teams of experts in both project financing and business transition support;

-

•alignment

of its financing, investment and insurance portfolios with trajectories compatible with

the objectives of the Paris Agreement:

- •by developing systems to measure carbon emissions,

- •by developing its system for identifying and managing climate, physical and transition risks to which its customers and its own activities are exposed, in a spirit of continuous improvement,

- •by gradually withdrawing from activities with the highest emissions, in particular through adapted ESG policies.

- In this context, the Group has joined the Net Zero Banking Alliance initiative of the United Nations Environment Programme (UNEP FI), and has a decarbonisation goal for the most carbon-emitting sectors. Banque Palatine is involved in this work;

Societal impact

Banque Palatine is committed to supporting local and national initiatives and assists organisations in the fields of art and culture, gender equality, sport.

1.2.1.1.2Sustainability-related targets

Among the strategic priorities of its new VISION 2030 strategy, Groupe BPCE is renewing its commitment to environmental and societal transitions. It is committed to making the impact accessible to all and to strengthening its global positive impact through the strength of its local solutions.

Banque Palatine is part of this strategy and has defined quantitative targets for 2025, broken down below:

Sustainable Finance indicators

Completed in 2024

2025 target

HQLA ESG (1)

17.1%

22%

Production of renewable energy

25% of total corporate

financing production in 202425% of total corporate

financing production in 2025 (2)Green portion of Banque Palatine

financing productionProduction impact loans

ESG questionnaire (active companies turnover > €3 million)

57%

70%

- (1)HQLAs are assets that can be quickly converted into cash without significant loss of value. They are used by banks to meet liquidity requirements, such as those imposed by the short-term liquidity ratio (LCR) under Basel III. ESG HQLA are compliant with Environmental, Social and Governance (ESG) criteria.

- (2)Due to the changing geopolitical context and European regulations

Own footprint indicators

Completed in 2024

2026 target

Carbon footprint reduction

+2% (compared

to 2023)

-6% (compared

to 2023)Despite efforts to reduce energy and travel costs, the year-on-year increase (between 2023 and 2024) is mainly due to the relocation of Banque Palatine's head office in May 2024 (with an increase in the Purchase and Waste item) which affected half of the bank's workforce.

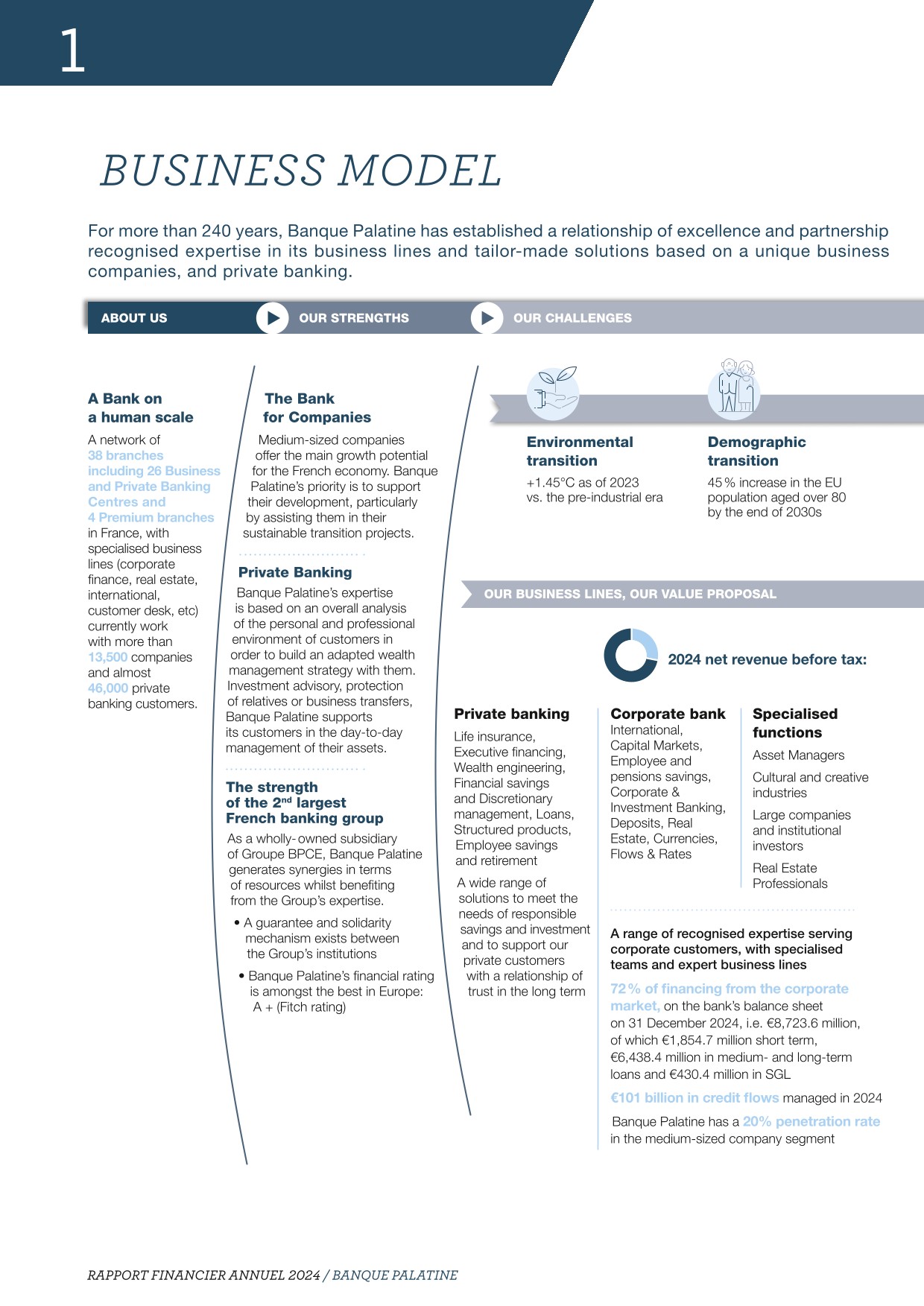

1.2.1.2Business model

Banque Palatine, a hybrid business model within Groupe BPCE

1.2.1.2.1Description of the main groups of products and/or services offered

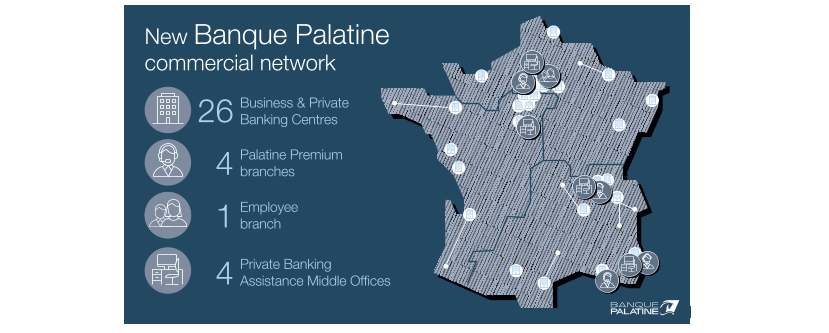

Banque Palatine, a 100% subsidiary of Groupe BPCE, is mainly dedicated to medium-sized companies, senior executives and private banking. For more than 240 years, Banque Palatine has been working alongside entrepreneurs on both a professional and personal level. It provides them with a range of banking products (current accounts, real estate and personal loans, financial investments, financing solutions to meet environmental challenges) and insurance products. Its network consists of 38 branches, including 26 business centres and private banking and four premium branches.

Banque Palatine offers value-added expertise dedicated to supporting its customers’ growth and performance: wealth, legal and tax engineering, investment advice, global approach to senior executives’ assets, corporate finance, specialised approach to real estate, trade finance, client desk, etc.

In the regulated real estate market, where the bank is the market leader, and in the audiovisual market, where it is a key player, it deploys a dedicated national organisation.

Its slogan “The art of being a banker” illustrates Banque Palatine’s desire to develop a local relational model based on excellent support for its customers.

Palatine Asset Management, a wholly-owned subsidiary of Banque Palatine, is a “premium boutique” asset management company focused on developing useful finance that gives meaning and value to its customer's investments.

Its value proposition is focused on the search for sustainable investment solutions to meet different investor profiles from institutional to private customers.

Its team, comprising around 30 employees with complementary profiles, has solid expertise in fixed income management, equity management and diversified management. This expertise is reflected in its range of funds and its portfolio management offer.

1.2.1.2.2Description of major markets and/or target customer groups

Banque Palatine, a wholly-owned subsidiary of BPCE SA, serves approximately 60,000 customers in France: 13,500 corporate customers and 46,000 private banking customers.

In 2024, Banque Palatine drew up its new strategic plan Palatine 2030, which is based on a purpose co-built with the bank’s employees, where Banque Palatine demonstrates its desire to actively engage in order to contribute to the energy and environmental transition by reducing its carbon footprint and supporting its customers in improving their impact.

The purpose of the bank is thus defined: “As a banking house since 1780, we have been shaping our know-how, our agility and a culture of excellence to be the trusted partner of our customers, both Corporate and Private Banking. We are convinced that French medium-sized companies and their senior executives are at the heart of the economic and socio-environmental challenges of today and tomorrow. As entrepreneurs at the service of entrepreneurs, we contribute to a more sustainable economy by investing in the success of their development, transformation and transmission projects”.

Customers are placed at the centre of Banque Palatine’s strategy as a fundamental priority. Risk expertise is confirmed as a marker of its differentiation. Finally, people are at the heart of its focus, making it the bank where the future of work is being shaped and experienced every day.

Banque Palatine’s vision for 2030 is illustrated by seven markers that reflect an ambitious development plan combining innovation, excellence and performance:

- •the bank of one in four medium-sized companies and one in two family-owned medium-sized companies,

- •the reference bank for supporting medium-sized companies in their transitions,

- •the benchmark for senior executives in terms of Private Banking,

- •the leading bank for asset managers (ADB),

- •a bank that innovates to strengthen its businesses in the areas of risk, data and new technologies,

- •a bank with the “Great place to work” label,

- •a bank that innovates to strengthen its businesses in the areas of risk, data and new technologies,

- •in the top 3 banks in the cultural and creative industry (cinema, streaming platforms, e-sports structures, content creators, live entertainment, etc.).

In addition, 20 major cross-functional projects were initiated by the end of 2024 to achieve the ambitious objectives by 2030. One of them is a “hat” project whose goal is to reach a new milestone for the CSR Committed label. Its objectives are to minimise the bank’s direct footprint, maximise its positive impact and engage even more with all its stakeholders. Another key project is the sustainable finance initiative, which aims to train sales teams in sustainable finance, define and roll out the bank's green strategy, set up a Palatine hub, foster a community of sustainable finance experts and enrich its offering.

1.2.1.2.3Description of the number of employees by geographical area

1.2.1.2.4Description of products and services prohibited in certain markets

Banking activities

Sector-specific ESG policies govern the activities of Groupe BPCE in sectors considered sensitive from an environmental, social and governance (ESG) point of view, including those of Banque Palatine.

- •thermal coal (the Group is applying a strategy to gradually reduce the exposure of its banking activities to thermal coal to zero by 2030 for the European Union and OECD countries and 2040 for the rest of the world),

- •oil and gas industry.

In addition, Banque Palatine has established strict rules regarding financing for real estate professionals: if the financing concerns an older residential property with an Energy Performance Diagnostic (EPD) rating of E, F or G, it can only be granted if renovation investments are planned. The same applies to commercial assets of less than 1,000 m² that do not meet the minimum criteria defined by the bank.

Palatine Asset Management activities

As part of its Responsible Investment approach, Palatine AM was quick to implement a policy to exclude the coal sector and monitor contentious issues in order to reduce its exposure to ESG risks, as well as its policy of excluding controversial weapons.

By excluding these issuers, Palatine AM wishes to focus its investment choices on the most responsible companies.

These exclusion lists have since been expanded to include the tobacco, oil and gas sectors, companies that violate the principles of the United Nations Global Compact, non-transparent issuers and, finally, the most carbon-intensive electricity producers.

In parallel with this exclusion policy, Palatine AM is also committed to engaging with companies to encourage them to improve their environmental, social and governance practices. The objective is to promote long-term sustainable performance.

The full policy is available at the following address: Palatine AM exclusion policy.

1.2.1.3Labels and commitments

Groupe BPCE

Groupe BPCE has made several long-standing commitments to scale up its actions and accelerate the positive transformations to which it is contributing.

Global Compact

Since 2003, the Group has been a participating member of the Global Compact (United Nations Global Compact), which defines ten principles relating to respect for human rights, labour standards, environmental protection and the fight against corruption.

Principles for responsible banking, UNEP Finance Initiative

Groupe BPCE signed the Principles for Responsible Banking on 23 September 2019 and are committed to strategically aligning their activities with the United Nations Sustainable Development Goals (SDGs) and the Paris Climate Agreement.

Net Zero Banking Alliance

In July 2021, Groupe BPCE joined the Net Zero Banking Alliance (NZBA), a financial initiative of the United Nations Environment Programme (UNEP FI) covering more than 40% of the assets financed by banks worldwide. This alliance between banking institutions is a decisive step in the mobilisation of the financial sector. In accordance with its commitment to align the trajectory of its portfolios with the objective of carbon neutrality by 2050, Groupe BPCE has published its ambitions for the eleven sectors with the highest carbon emissions (power generation, oil and gas, automotive, steel, cement, aluminium, aviation, commercial real estate, residential real estate and agriculture).

Act4Nature

Because protecting biodiversity is one of the greatest challenges of our time, Groupe BPCE, by joining Act4Nature International in 2024, is strengthening its commitment to the environment by renewing the partnership supported by Natixis since 2018. The Group has joined act4nature international, a coalition that mobilises businesses, public authorities, scientists and environmental associations to protect, promote and restore biodiversity, and has set itself 24 ambitious targets as part of its activities as a bank, insurer and investor.

Palatine Asset Management

Principles for responsible investment

In addition, the principles for responsible investment (PRI) were introduced by the United Nations in 2006. This voluntary commitment, aimed at asset management players, encourages investors to integrate environmental, social and governance (ESG) issues into the management of their portfolios. The PRI are a means for promoting the generalisation of the consideration of non-financial aspects by all financial businesses.

At the end of 2019, Palatine Asset Management joined the signatories of the principles for responsible investment.

Banque Palatine

CSR Committed Label

Banque Palatine was labelled CSR Committed by AFNOR in May 2024 for a period of three years and obtained the level of progression. This label enables the maturity of an organisation’s CSR initiatives to be assessed on the basis of ISO 26000 (international CSR standard). It is also a tool for strategic thinking and appropriation of CSR issues, internal mobilisation, management and structuring of the CSR approach with stakeholders.

Professional Equality Label

Banque Palatine also obtained the Professional Equality Label from AFNOR. Issued for four years, this label is a mark of recognition of the actions performed in favour of professional equality by an approved independent body.

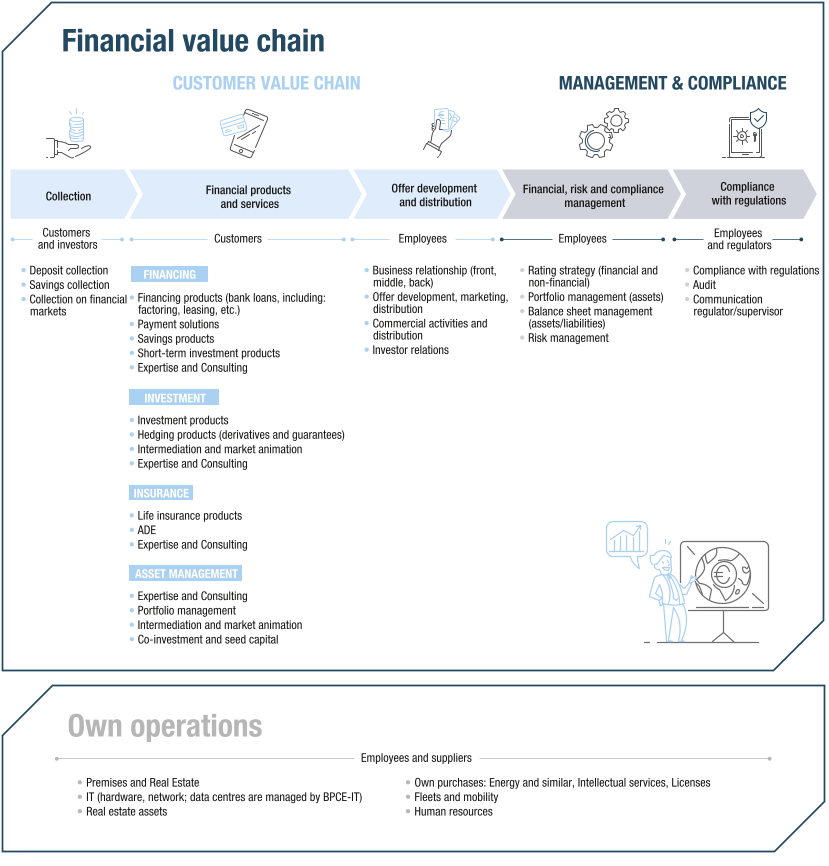

1.2.1.4Value chain

As a financial institution, Banque Palatine receives funds in the form of customer deposits or purchases of financial instruments by investors and grants loans to its customers (banking transformation function).

The downstream value chain includes customers who benefit from Banque Palatine's products or services, particularly loans.

1.2.2SBM 2 - Interests and views of stakeholders

It is essential for Banque Palatine to take its stakeholders into account in order to improve how it identifies and assesses its sustainability impact. Groupe BPCE is committed to maintaining an ongoing dialogue with its counterparties. The stakeholder consultation process within Groupe BPCE is based on a large number of systems whose purpose is to co-construct and involve our stakeholders in our process of identifying and assessing impacts, risks and opportunities, as well as levers for improving our positive impact on both environmental and societal issues.

With regard to Banque Palatine, stakeholder expectations are also identified and taken into account through regular contact with the senior executives of the Banques Populaires and Caisses d'Epargne, as the board members of Banque Palatine are corporate officers of these institutions. But also via meetings with rating agencies, discussions with regulators, image surveys and prospective surveys. Finally, surveys of the bank's employees and regular meetings with staff representatives are also good ways to identify changes in stakeholder expectations.

The partnership with a consulting firm has been set up to support our medium-sized corporate customers in taking into account their environmental challenges. In addition, a sustainable finance programme has been set up to meet the expectations of our customers.

■Summary of stakeholder dialogue

Stakeholders

Dialogue methods

Purpose

Board members

- •Participation in specialised committees

- •Training programmes and seminars

- •Participation in the definition of strategic orientations

- •Monitoring function, in particular risk management and reliability of internal control

Employees

- •Social survey (internal survey measuring the social climate in the Group’s companies) and business line satisfaction survey

- •Annual interviews

- •Training

- •Internal communication

- •Non-profit networks (women, intergenerational, LGBT+)

- •Employee whistleblowing rights

- •Consultation of employee representatives and representative trade unions

- •Improving quality of life at work, health and safety at work

- •Employee loyalty and commitment (career and talent management, skills and expertise development)

- •Participation of employee representatives in major strategic and transformation issues and negotiation of agreements

- •Measurement of satisfaction

Customers

- •Interviews

- •Dedicated dialogue to integrate ESG issues

- •Customer events

- •NPS satisfaction surveys

- •Institutional and commercial partnerships

- •Voting policies (available on the websites of the asset management subsidiaries)

- •Definition of offers and customer support

- •ESG dialogue: customer acculturation on ESG issues, support for transformation initiatives, risk assessment for better prevention and management by the customer and for incorporation of ESG criteria in the granting of loans

- •Improving customer satisfaction

- •Monitoring of the respect for compliance and ethics rules in commercial policies, procedures and sales

- •Complaint management

- •Mediation

Suppliers and sub-contractors

- •Responsible purchasing policy

- •Regular meetings with strategic suppliers

- •“Supplier voices” survey

- •Preparation of certifications

- •Listening system and satisfaction surveys

- •Supplier whistleblowing rights and establishment of an independent mediator

- •Audit

- •Responsible Supplier Relations Charter, involving suppliers in the implementation of duty of care measures

- •Compliance with ESG clauses included in contracts

- •Identification of progress plans to better understand supplier expectations

- •Improving the level of satisfaction and the relationship

- •Consultations and calls for tenders

- •Measurement of satisfaction

Institutions, federations, regulators

- •Regular meetings (public authorities, regulators, chambers of commerce and industry, etc.)

- •Contribution to the work of the financial market, participation in sectoral working groups

- •Responses to public consultations

- •Transmission of information and documents

- •Constructively contributing to public debate and participate in collective, fair and informed decision-making

- •Taking into account sector specificities

- •Regulatory compliance

Rating agencies, investors and independent third parties

- •Regular dialogue, participation in meetings (technical meetings, roadshows, conferences, etc.)

- •Transfer of information and documents for ratings/audits

- •Publication of official documents: annual report, half-year report, press releases, investor website

- •Improving transparency

- •Diversification of the Group’s refinancing, in particular by promoting the issuance of Green/social/sustainable bonds

- •Improving financial and non-financial ratings

- •Meeting the expectations and questions of investors and rating agencies

- •Publication of reports

NGOs and non-profits

- •Calls for projects

- •Sponsorship

- •Employee volunteering, skills sponsorship

- •Regular discussion

- •Contributions to market questionnaires

- •Board seats

- •Positive impacts through numerous cultural and solidarity initiatives in various fields: business creation, integration, solidarity, young people, sport, environmental protection, etc.

- •Improving transparency

- •Contribution of cross-expertise: banking/financial and better understanding of local players

Academic and research sector

- •Relations and partnerships with business schools and universities

- •Participation in forums and events

- •Discussions and consultations with scientific experts

- •Recruitment of work-study students and interns

- •Improving the employer brand

- •Contribution to the Group’s research, working groups and strategies

1.2.3Sponsorship policy - partnerships

Banque Palatine’s philanthropic commitment, solidarity actions and sponsorship are carried out jointly by the General Secretariat (CSR Department) and the Communications Department. The guidelines and policies of their commitments are coordinated at the national level and are then rolled out nationally and for certain local actions, at the regional level.

Banque Palatine’s policy in terms of partnerships and sponsorship is based on three priority areas: gender equality, sport and culture. Banque Palatine promotes gender equality in sport (equality between men and women and between able-bodied athletes and para-athletes) through various initiatives, such as the Palatine Women Project, support for athletes via the French Sports Foundation and sponsorship of the Alice Milliat Foundation. Banque Palatine also supports the cultural sector in France. This is reflected in particular by its cultural sponsorship with regional contemporary art structures (the Museum of Contemporary Art of Lyon, Bordeaux, Nantes and FRAC Sud de Marseille) and the Opéra-Comique in Paris, as well as its partnership with Série Séries and the creation of the Gloria Palatine Prize, designed to support the audiovisual industry and highlight gender equality in this sector.

Banque Palatine also supports Cancer@work, a charity that works to raise awareness about cancer in the workplace, and the Gustave Roussy Institute. Some employees took part in Odyssea (a race organised to raise funds for the fight against breast cancer) and Movember (an organisation that raises awareness of men's health issues and donates funds to charities working in this field), which enabled the bank to make several donations to the charity.

In addition, as part of the microgiving campaign, Banque Palatine donates the equivalent of the rounded-up amounts from salaries to charities: the Institut Curie and the Fondation des Femmes.

Measures implemented or continued in 2024

Banque Palatine, a premium partner of the Paris 2024 Olympic and Paralympic Games, has been supporting several athletes and para-athletes since 2021 as part of the Performance Pact program, a French Sports Foundation scheme supported by the French Ministry of Sports. This programme seeks to help French athletes succeed by providing them with an income and thus supporting their life plans (training, social and professional integration, equipment purchases, travel for sporting events, etc.) through sponsorship. Banque Palatine sponsored four athletes in 2024: Gaëlle Edon in para shooting sports, Élodie Clouvel in modern pentathlon, Nicolas Muller in golf and Alexandre Léauté in para cycling. Banque Palatine selected a gender-balanced team with two women and two men, and two able-bodied athletes and two para-athletes. In total, three sponsored athletes took part in the Paris 2024 Olympic and Paralympic Games and won four medals. Banque Palatine has decided to continue its commitment to French athletes by renewing this programme in 2025.

Banque Palatine, which is committed alongside entrepreneurs, has created a mentoring programme to support high-level female athletes and para-athletes who have an entrepreneurial project. In 2024, the third edition of the “Palatine Women Project” programme supported five athletes: Myriam Benadda, Aude Bredel, Maé-Bérénice Méité, Malia Metella and Audrey Prieto. A total of 16 athletes have participated in the programme since its launch and have been backed by a community of Banque Palatine employees, institutions and businesses to help them achieve their goals. Banque Palatine has mobilised institutions such as URSSAF, the Ministry of Sport, and companies such as Uniqlo and Education First through this programme to create an active community supporting female entrepreneurs in sport.

In 2021, Banque Palatine became the leading sponsor of the Alice Milliat Foundation, the first European foundation to promote women’s sport. Created in response to gender inequality in sport, it is part of the Fondation de France and is recognised as being an organisation in the public interest. The Alice Milliat Foundation helps raise the profile of women's sport and give women a more prominent place in the sporting world.

Banque Palatine's sponsorship enables the financing of grassroots initiatives, raises awareness of women's sport and boosts the visibility of female athletes in society. In this context, Banque Palatine took part in the Festival des Sporting en Lumière organised in Nice in 2024. Its aim is to showcase the latest productions featuring sportswomen. Banque Palatine is also the leading sponsor of the Trophées Alice Milliat, which aims to highlight female sports players in France. This ceremony was attended by over 300 participants, including ministers and members of the media....

Banque Palatine has been involved in cultural sponsorship in different regions of France since 2023. It has become a sponsor of the contemporary art museums in Lyon, Nantes and Bordeaux, and of FRAC Sud in Marseille, to help boost innovation and excellence in contemporary art in these regions. It has also become a sponsor of the Opéra-Comique – Théâtre national de Paris, a beacon of French creativity. These commitments were renewed in 2024. These cultural sponsorships support creation and artistic excellence as well as access to culture for all. This sponsorship also has a social and educational purpose, as it enables organisations to develop their offerings for all audiences: children, retirees, disadvantaged groups, people with disabilities, etc. In addition, this commitment is reflected by developing local artistic activities for the bank's customers, giving real meaning to the slogan "the art of being a banker".

As a long-standing partner of the Série Séries, Banque Palatine wanted to intensify its involvement in 2022 with the creation of the Gloria Palatine prize. This prize seeks to encourage and promote greater representation of women in the audiovisual sector, both at the heart of the creative process and/or in the themes explored in the work. Banque Palatine has awarded the winning writer-producer duo a prize of €5,000 every year since 2022. This partnership demonstrates Banque Palatine’s strong commitment to gender equality in the audiovisual industry, particularly in writing and production functions.

Future work

Banque Palatine is continuing its commitment to top-level athletes, as part of the Palatine Women Project. The programme is growing every year, with 50 applications received for the 2025 edition. The number of sponsored athletes will therefore be increased for this new session.

Banque Palatine also remains committed to the French Sports Foundation and has formed its new Team of four athletes: Alexandre Léauté, para-cyclist; Élodie Clouvel, pentathlete; Ugo Coussaud, golfer; and Gaëlle Edon, para-athlete specialising in shooting sports.

Finally, Banque Palatine is renewing its commitment to the French Golf Federation in order to promote the sport and make it accessible to as many people as possible.

As part of the CSR roadmap of the Palatine 2030 strategic plan, Banque Palatine is committed to developing partnerships with local charities and stakeholders in projects that have a positive social impact.

- •strengthen its support for mentoring female athletes who want assistance in developing their entrepreneurial projects by setting up a dedicated endowment fund;

- •maintain its commitments to the fight against cancer through Odyssea, Gustave Roussy, cancer at work, etc.;

- •increase its participation in projects related to biodiversity;

- •maintain its commitments to art and culture.

1.3Governance

1.3.1GOV 1 - The role of the administrative, management and supervisory bodies

1.3.2GOV 2 - Information provided to the company’s administrative, management and supervisory bodies and sustainability issues addressed by them

1.3.2.1Sustainability topics addressed by the administrative, management and supervisory bodies

Organisation of governance relating to Banque Palatine’s sustainability issues

Banque Palatine's decision-making bodies incorporate transparency, ethical behaviour, respect for stakeholder interests and the principle of legality. They also take the duty of care regarding CSR actions into account.

Sustainability issues come within the remit of two bodies within Banque Palatine: the General Secretariat (CSR Department) and the Sustainable Finance Programme. The General Secretary and the Programme Director both report to executive management or deputy executive management and are members of Banque Palatine’s Executive Management Committee and are invited to attend the Executive Committee.

The Executive Committee validates the ESG strategy, ensures its implementation and oversees risk management (the composition and diversity of the Committees and Board of Directors, and of executive governance, the roles and responsibilities of the bodies are detailed in chapter 1.3 - Corporate Governance).

The Board of Directors meets as often as the company’s interests and legal and regulatory provisions require, and at least once per quarter. Several specialised committees have been set up by the Supervisory Board and carry out their activities under its responsibility. Their duties are defined in the Board of Directors’ internal rules. The Chairman of each of these committees reports on the committee’s work to the Board.

Various CSR topics are submitted to the Board of Directors for information and decisions. The following were presented in 2024: the previous year's published statement on non-financial performance, the launch of work on the CSRD, updates on the drafting of the sustainability report, the stakeholder questionnaire and its results, a review of Banque Palatine's actions in relation to biodiversity and corporate sponsorship, the CSR and sustainable finance projects of the new Palatine 2030 strategic plan presented at a Board of Directors seminar and to the Board, and the CSRD audit plan. The workplace equality policy was also discussed.

These subjects were presented in advance respectively to the Risk Committee for the statement on non-financial performance and to the Audit Committee for the sustainability report.

- •quarterly in the Executive Management Committee (around 15 directors representing the bank’s main business lines) and in particular for the update of the UP 2024 strategic plan, which identified non-financial indicators on topics relating to gender equality, sustainable financial savings and the carbon footprint;

- •regularly in the Executive Committee (e.g. approval to engage the bank in a CSR certification process, sponsorship, etc.).

1.3.3GOV 3 - Integration of sustainability-related performance in incentive schemes

Concerning the members of the Board of Directors of Banque Palatine

Sustainability performance is not taken into account in the calculation of board members' remuneration, as presented in chapter 1.3 of the corporate governance report.

Concerning the effective managers who are members of executive management

- •A fixed remuneration which primarily reflects professional experience related to the position held and the responsibilities exercised, and is determined by comparison to market practices.

- •annual variable remuneration, 40% of which is indexed to quantitative criteria (net revenue before tax, COEX and net result, Group share), 20% to criteria linked to BPCE's results and 40% to qualitative criteria, which can amount to, when the targets are met, 80% of the fixed remuneration for the Chief Executive Officer (50% for the Deputy Chief Executive Officer) and up to 100% of this same base amount (62.5% for the Deputy Chief Executive Officer) in the event of outperformance. These criteria are shared by the members of the Executive Committee and the Executive Management Committee.

The award of annual variable remuneration partly depends on the implementation of the bank's CSR goals. In recent years, CSR indicators have been: the professional equality index (5%), the increase in SRI outstandings (10%), the share of impact loans, including green loans in the production of corporate loans (10%), the employee engagement rate (5%), assessment of the green strategy (5%), NPS rate (10%).

The Board of Directors, through its Remuneration Committee, is responsible for setting the method and amount of remuneration for each effective manager. It ensures that CSR issues are fully integrated into the remuneration policy.

1.3.4GOV 5 - Risk management and internal controls over sustainability reporting

Main features of the risk management and internal control system linked to the sustainability reporting procedure

1.3.4.1Preparation and publication of sustainability information

Roles and responsibilities

The development and processing of sustainability information within Banque Palatine is mainly the responsibility of the following three departments:

- •General Secretariat including the CSR and Financial Communication Department;

- •Sustainable Finance Programme.

The General Secretariat, and more specifically the CSR Department, played a key role in coordinating the work of preparing the CSRD sustainability report:

- •coordination of project committee and governance internally, including interaction with other Group entities that prepare their own sustainability report;

- •enhanced coordination of the processes for producing the regulatory indicators required by the ESRS, including a test system involving all production entities;

- •interaction with auditors.

- •coordinating and producing presentations of quarterly results, the financial structure and the development of the Group’s business lines to enable third parties to form an opinion on its financial strength, profitability and outlook;

- •coordinating and preparing the presentation of regulated financial information (annual and half-yearly report) filed with the French Financial Markets Authority (AMF).

In the context of preparing the sustainability report, the General Secretariat plays a key role in coordinating the work undertaken by all contributing departments. It participates in the management of the project and is involved in three major projects:

Acculturatiuon to the CSRD and dialogue with stakeholders, co-led with the Sustainable Finance Programme:

- •first objective of this area: to present and train the bank’s employees involved in the production of the sustainability report. To this end, educational materials were provided and training sessions were held to support the contributing business lines and entities;

- •second objective: develop specific tools, such as questionnaires, to collect stakeholders' expectations regarding sustainability issues and thus strengthen trust and relationships with them.

The General Secretariat proposes, validates and implements the ESG strategy with the Sustainable Finance Programme. It plays a cross-functional role, carrying out the following key missions:

- •co-constructs the Palatine 2030 strategic plan for the Impact section on the E, S and G aspect;

- •develops and deploys ESG expertise and ensures that the Group is represented and communicates in the market;

- •conducts and interprets scientific and competitive monitoring and supports regulatory monitoring;

- •ensures overall coordination and supports each business line while implementing the necessary synergies.

The General Secretariat and the Sustainable Finance Programme are more specifically involved in the following projects:

- •CSRD acculturation: a meeting to present the CSRD directive and its challenges, in particular for medium-sized corporate customers, was organised in June 2024, led by an expert in these subjects, with the Marketing Department and the sales representatives of the Corporate and Private Banking markets. Furthermore, a training/acculturation meeting was planned for September for all employees in the Project Team as part of the CSRD Project structure put in place in July 2024. The purpose of this meeting was to provide a background and perspective on the CSRD project, to explain the regulatory and strategic expectations of the directive, to shed light on certain new structuring concepts and their implementation, and to share the project organisation put in place at the Banque Palatine level to implement the CSRD and share best practices, next steps and the tools/resources made available to us by the Group and within Banque Palatine;

- •double materiality analysis: this analysis was carried out in two stages, managed exclusively by the General Secretariat (for a detailed description, see ESRS2 IRO1);

- •the identification of impacts, risks and opportunities (IRO) relevant to the bank’s activity was coordinated by the General Secretariat by drawing on the bank’s business lines. The identification of the IROs was carried out in two phases, A and B, by the General Secretariat respectively. Phase A enabled the topics and subtopics of the ESRS relevant to Groupe BPCE to be identified through workshops with internal business line experts, and then to carry out an initial identification of the IROs. The final list of IROs relevant to the bank was drawn up during phase B;

- •assessment of the materiality of these IROs: BPCE's Impact Management Department has established a methodology for rating IROs for the Group. This rating process was coordinated and supervised by the General Secretariat, in liaison with the internal stakeholders mentioned above. The business lines and functional departments are responsible for rating the IROs within their scope;

- •communication strategy and editorial content: the General Secretariat is responsible for the bank's Impact strategy and ensures that the editorial content of the sustainability report is relevant and consistent with the bank's strategy on sustainability issues;

- •transition plan: Palatine does not have its own transition plan for this first financial year.

Methods for producing and publishing sustainability reports

The central body prepares the sustainability report in accordance with the requirements defined by the CSRD directive (Corporate Sustainability Reporting Directive).

It also ensures that the rules defined by the Group are properly applied by the bodies subject to this requirement and checks compliance with these requirements.

- •a project structure dedicated to the publication of sustainability statements and distributed to all Group entities;

- •a process for consolidating all the information to be published in the sustainability report, including controls to ensure the consistency of the information published and the analyses;

- •a complete body of documentation;

- •a harmonised permanent control framework, the organisation of which is described in the following section (GOV-5 - 1.3.4.2).

1.3.4.2General organisation of permanent control

General system

The internal control framework defined by the Group contributes to the control of risks of all kinds and is governed by a governing charter – the Group Internal Control Charter – which stipulates that this system is designed, in particular, to ensure “[...] the reliability of financial and non-financial information reported both inside and outside the Group”.

The Group has defined and implemented a permanent control framework to ensure the quality of this information, in accordance with the requirements defined by the order of 3 November 2014 on internal control, or any other regulatory obligations relating to the quality of reports, and in particular for the publication of information on sustainability.

This permanent control framework is set up within Banque Palatine. In order to ensure strict independence in the implementation of controls, the permanent control framework is based on two levels of controls:

- •a first level exercised by all those involved in the production and reporting process;

- •a second level carried out by the Financial Control unit attached to the bank's Risk Management and Compliance Department.

CSRD reporting has been included in this control framework since 1 January 2025 to ensure compliance with the requirements defined by:

- •the Corporate Sustainability Reporting Directive (CSRD),

- •the Group within the Framework for developing and publishing reports and management indicators, which aims to harmonise reporting practices within the Group.

The bank’s business lines that produce information for CRSD reporting are: Finance, Risks, Compliance, Human Resources, Sustainable Finance, Purchases and General Secretariat. As a prerequisite for implementing CRSD reporting controls, the production process will have been modelled, identifying sub-processes and their respective specialists.

First-level control framework

The production specialist, in conjunction with the contributors, will implement a first-level Self Assessment grid (BCBS239 terminology) (Lod1) which covers the following items:

- •existence of group and Palatine documentation of the CSRD production (procedures and/or operating methods, etc.);

- •existence of self-checking and hierarchical validation procedures;

- •performance of the first-level controls planned;

- •formalisation of the results of these first-level controls;

- •in the event of anomalies identified, existence of remediation plans to resolve them on a long-term basis.

- •the existence of audit trails for the creation of indicators;

- •reconciliation with the financial statements, if applicable;

- •analysis of changes;

- •the quality of the sources (special attention must be paid to office and manual sources) and the accuracy of the data collected from external suppliers;

- •the existence of limitations, i.e. degraded procedures for the production of certain indicators;

- •the inclusion of these limitations in the CSRD report.

A Second-level control framework: the independent review of the CRSD report

Financial Control will carry out a second-level independent review of the report based on the implementation of strict criteria. This review, organised to ensure that the regulatory requirements are met, mainly aims to obtain an opinion or reasonable assurance that the reports are produced and published in a satisfactory internal control environment and that they include reliable, clear useful and auditable data.

This second-level control takes the form of a standardised Group Self Assessment grid (Lod2) based on six analysis areas weighted from 1 to 3 and covering:

- •the quality of the documentation;

- •the robustness of the organisation relating to the production and publication of the report;

- •the quality of the audit trail of the data and/or indicators included in the reporting;

- •the effectiveness of the system of first-level controls;

- •the accuracy of the data and/or indicators published and their consistency with the information provided in other publications;

- •the clarity of the information

These controls are implemented according to a group rating method which scores the results of the controls on a scale between 1 (requirement not met) and 4 (requirement fully met):

The results of these controls are formalised and reported in a summary note which is included in the Lod2 grid. This note presents, without being exhaustive, the work carried out as part of its controls and the conclusions of this work, specifying in particular the anomalies identified and, where applicable, the recommendations issued (or action plans or corrective measures).

The results are integrated, by criterion, into the Group's permanent control tool (Priscop) and the conclusions are shared with the units audited, external control bodies (statutory auditors in particular) and the Banque Palatine's Internal Control Coordination Committee and Audit Committee.

The implementation of corrective actions (recommendations issued) and/or identified areas for improvement is monitored in conjunction with the business lines and after the publication of the Group's sustainability report in order to strengthen the system for subsequent publications. This monitoring is reported to Banque Palatine's Coordination Committee for Internal Control Functions and Audit Committee.

Main features of the environmental, social and governance risk management system

The environmental, social and governance risk management system is described in detail in chapter 4 of the 2024 Risk Management Report.

Definition of ESG risks

Environmental risks

- •Physical risks arising from the impacts of extreme or chronic climate or environment events (biodiversity, pollution, water, natural resources) on the activities of Groupe BPCE or its counterparties;

- •Transition risks arising from the impacts of the transition to a low-carbon economy, or one with a lower environmental impact, on Groupe BPCE or its counterparties, including regulatory changes, technological developments, and the behaviour of stakeholders (including consumers).

Social risks